Recent GST Changes in India (2025): Everything You Need to Know

📌 Introduction

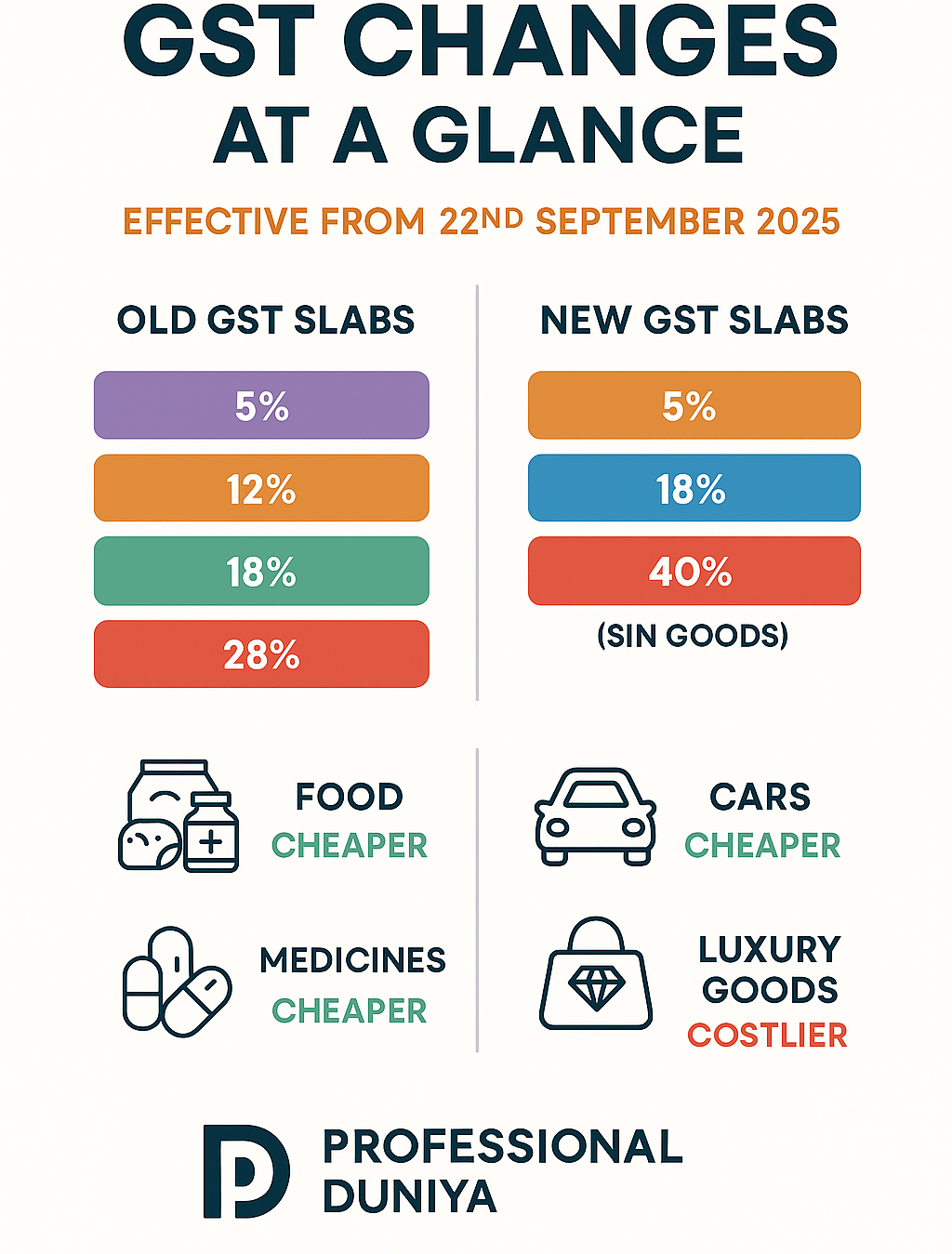

The Goods and Services Tax (GST) Council, in its landmark meeting on 3rd September 2025, announced one of the biggest reforms since GST was first rolled out in 2017. From 22nd September 2025, India will switch to a simpler, consumer-friendly GST regime with lower rates on essentials, reduced slabs, and big relief for middle-class families.

🔑 Key Highlights of GST Changes (Effective 22nd September 2025)

Category Old GST Rate New GST Rate Impact Packaged Food, Toothpaste, Soap, Shampoo 12–18% 5% Cheaper UHT Milk, Paneer, Roti, Chapati, Khakhra 5% 0% (Tax-Free) Cheaper Life-saving Medicines & Cancer Drugs 5% 0% (Tax-Free) Cheaper Cement 28% 18% Cheaper Fertilizers, Drip Irrigation, Biopesticides 12% 5% Cheaper Small Cars (≤1200cc petrol / ≤1500cc diesel), Bikes ≤350cc 28% 18% Cheaper Electric Vehicles 5% 5% (No Change) Affordable Luxury Cars, Tobacco, Aerated Drinks 28% + Cess 40% Sin Slab Costlier

🎯 Why This Matters

✅ Simpler GST Slabs → Old 5%, 12%, 18%, 28% replaced by 5%, 18%, 40% (sin goods).

✅ Lower Cost of Living → Essentials, insurance, medicines become cheaper.

✅ Boost to Sectors → Auto, FMCG, Cement, Agriculture expected to benefit.

✅ Inflation Relief → Prices may ease by 1%+, boosting consumption.

💡 Impact on You

Consumers → More savings on groceries, health, and daily essentials.

Businesses → Simpler compliance, reduced tax burden, more predictable pricing.

Investors → Stock market already reacting positively; auto, FMCG, infra may see strong growth.

📅 When Do These Changes Apply?

All the new GST rates will be effective from 22nd September 2025, just in time for Navratri and festive shopping.

📌 Conclusion

The 2025 GST overhaul is set to bring relief to households, stimulate demand in critical sectors, and simplify India’s indirect tax regime. While luxury and sin goods will cost more, the middle class and essential sectors stand to gain the most.

Great choice 👌 Adding FAQ-style Q&A at the end of your blog will boost SEO and increase chances of appearing in Google’s People Also Ask (PAA) results.

Here’s a ready-to-use Featured Snippet (FAQ Section) for your GST blog:

❓ Frequently Asked Questions (FAQ) on Recent GST Changes 2025

1. What are the new GST slabs in India 2025?

From 22nd September 2025, GST will follow a simplified three-slab structure:

5% – For essentials and daily consumables

18% – For most goods and services

40% (Sin Slab) – For luxury and demerit goods such as tobacco, aerated drinks, and luxury cars

2. Which items are now GST-free in 2025?

The following items are now tax-free (0% GST):

UHT milk, paneer, roti, chapati, khakhra

Life-saving medicines and cancer drugs

Individual health and life insurance policies

3. What items got cheaper after GST changes 2025?

Packaged foods, toothpaste, soap, shampoo → 5% GST

Cement → 18% (earlier 28%)

Small cars, bikes (≤350cc), auto parts → 18% (earlier 28%)

Fertilizers, drip irrigation, biopesticides → 5% GST

4. What items will be costlier after GST 2025 reforms?

Tobacco products, cigarettes, pan masala

Sugary aerated drinks

Large luxury cars, private aircraft, yachts

All fall under the 40% GST “sin slab”.

5. When will the new GST rates be effective?

The new GST rates will be effective from 22nd September 2025, just before the festive season (Navratri & Diwali).

📝 Need GST Registration?

Get your GST Registration done quickly and hassle-free with Professional Duniya.

✅ Online Application Support

✅ Expert Guidance for Documents

✅ Affordable Service Charges

✅ Complete Compliance Assistance

📌 Get GST Registration in just 3 days! Start at just Rs.699*

👉 Start your GST Registration today at