GST Rates List 2025 – Updated Tax Slabs, HSN Codes & Download PDF

Check the latest GST rates list 2025 with updated tax slabs and HSN codes. Download GST rate chart PDF and stay updated with new GST changes for businesses.

9/7/20252 min read

📌 Introduction

The Goods and Services Tax (GST) is the backbone of India’s indirect taxation system. Every year, GST rates are revised to simplify compliance, boost business, and regulate inflation. If you are a trader, MSME, or business owner, knowing the latest GST rates is crucial for accurate billing, pricing, and tax filing.

In this blog, we bring you the Updated GST Rates List for 2025, along with insights on how these changes impact small businesses and entrepreneurs.

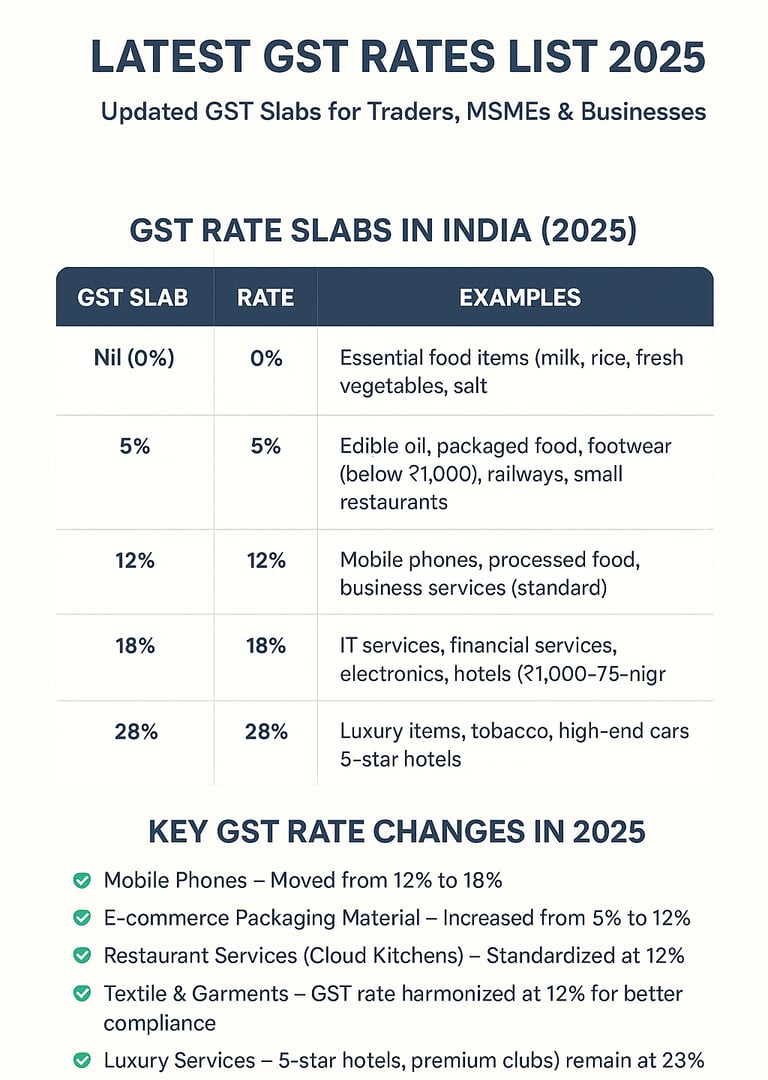

📊 GST Rate Slabs in India (2025)

As per the recent GST Council updates (Sept 2025), here are the applicable slabs:

GST Slab Rate Examples Nil (0%): 0%Essential food items (milk, rice, fresh vegetables, salt)

GST Slab Rate Examples 5%: 5%Edible oil, packaged food, footwear (below ₹1,000), railways, small restaurants

GST Slab Rate Examples 12%: 12%Mobile phones, processed food, business services (standard)

GST Slab Rate Examples 18%: 18%IT services, financial services, electronics, hotels (₹1,000–₹7,500/night)

GST Slab Rate Examples 28%: 28%Luxury items, tobacco, high-end cars, 5-star hotels

🔍 Key GST Rate Changes in 2025

✅ Mobile Phones – Moved from 12% to 18%

✅ E-commerce Packaging Material – Increased from 5% to 12%

✅ Restaurant Services (Cloud Kitchens) – Standardized at 12% (earlier varying rates)

✅ Textile & Garments – GST rate harmonized at 12% for better compliance

✅ Luxury Services (5-star hotels, premium clubs) remain at 28%

👨💼 Impact on Traders & MSMEs

Better Input Tax Credit (ITC): Uniform 12% rate for textiles & garments simplifies ITC claims.

Increased Costs for Retailers: Electronics & mobile resellers face higher GST (18%).

Boost for Cloud Kitchens & Startups: Simplified GST on food delivery brings clarity.

Exporters & E-commerce Sellers: Need to recheck updated HSN codes and apply revised rates.

📌 Documents Needed for GST Compliance (2025)

GSTIN certificate

HSN/SAC codes for your goods & services

Sales & purchase invoices

E-way bills (for transport)

✅ Pro Tips for MSMEs & Traders

Always check HSN Code Mapping before applying GST.

Use cloud accounting tools (Zoho, Tally Prime, QuickBooks) for real-time GST tracking.

File returns on time (monthly/quarterly) to avoid penalties.

Claim ITC wherever applicable to reduce tax burden.

💬 Frequently Asked Questions (FAQs)

Q1. What is the GST rate on food items in 2025?

Most essential food items are exempt (0%), while packaged food attracts 5%.

Q2. Has GST increased for small businesses in 2025?

Yes, certain items like mobiles & packaging material now fall under higher slabs (12%–18%).

Q3. Do traders need to update GST software after new rates?

Yes, billing software must reflect the latest GST rates 2025 for compliance.

📈 Conclusion

The latest GST rates list 2025 is designed to bring uniformity and simplify compliance for businesses. Whether you are a trader, MSME, or startup, staying updated with GST slabs is critical to avoid penalties and plan pricing strategies.

👉 At Professional Duniya, we provide end-to-end GST Registration, Filing, and Compliance Support to help your business stay ahead.

📞 Call us at +91-9310326387 | 📧 professionlduniya@gmail.com | 🌐 [Get GST Help Online]

Professional Duniya

© 2025. All rights reserved with Professional Duniya

Usage

Services

Trademark Filing

Partnership Registration

Growth