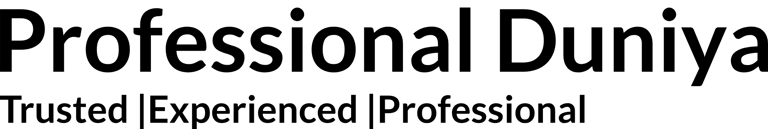

Step-by-Step Guide to Online GST Registration in India (2025)

Learn how to apply for GST registration online in India (2025). ✅ Step-by-step process, required documents, benefits & FAQs explained.

9/6/20252 min read

📑 Step-by-Step Guide to Online GST Registration in India (2025)

If you are a business owner, freelancer, or e-commerce seller in India, getting a GST registration is one of the most important steps to stay compliant and grow your business. Since GST (Goods & Services Tax) is mandatory for businesses with turnover above the threshold, registering early saves you from penalties and builds credibility.

In this blog, we’ll walk you through the latest GST registration process in 2025, required documents, eligibility, and FAQs.

✅ Who Needs GST Registration in India?

You must register under GST if you are:

A business with annual turnover above ₹40 lakh (₹20 lakh for services).

An e-commerce seller (Amazon, Flipkart, etc.).

A casual taxable person or business operating across states.

A business dealing in interstate sales of goods/services.

Required under reverse charge mechanism (RCM).

📋 Documents Required for GST Registration

PAN Card of business/owner

Aadhaar Card of proprietor/partners/directors

Proof of business registration (Partnership Deed, Incorporation Certificate, etc.)

Address proof of business place (Electricity Bill, Rent Agreement, NOC)

Bank account proof (Cancelled Cheque / Bank Statement)

Passport-size photo of applicant

🛠️ Step-by-Step Online GST Registration Process (2025)

Follow these steps to register on the GST portal (www.gst.gov.in):

🔹 Step 1: Visit GST Portal

Go to 👉 www.gst.gov.in and click on “New Registration” under the Services tab.

🔹 Step 2: Fill Basic Details

Select taxpayer type (Business/Individual).

Enter state, district, PAN, email ID, and mobile number.

Enter OTP received on mobile/email.

🔹 Step 3: Generate Temporary Reference Number (TRN)

You will receive a TRN to proceed with Part B of registration.

🔹 Step 4: Fill Part B Application

Enter business details, bank account info, and address proof.

Upload documents (PAN, Aadhaar, Bank Proof, Address Proof).

🔹 Step 5: Verification via DSC/EVC

Companies/LLPs must sign using DSC (Digital Signature Certificate).

Proprietors can use Aadhaar-based OTP (EVC).

🔹 Step 6: ARN Generation & Application Status

Once submitted, you get an Application Reference Number (ARN) to track your status.

🔹 Step 7: GSTIN Allotment

If verified successfully, you receive a 15-digit GSTIN and GST Registration Certificate within 7–10 working days.

🎯 Benefits of GST Registration

Legal recognition of your business

Enables you to collect GST from customers

Input tax credit on purchases

Increases trust & credibility with vendors/clients

Essential for e-commerce selling

💬 Frequently Asked Questions (FAQs)

Q1: Is GST registration free of cost?

👉 Yes, applying on the official GST portal is completely free.

Q2: What is the penalty for not registering under GST?

👉 Penalty is 10% of tax due (minimum ₹10,000) for non-compliance.

Q3: Can I apply GST registration without PAN?

👉 No, PAN is mandatory for GST registration.

Q4: How long does GST registration take?

👉 Normally, 7–10 working days if documents are correct.

📌 Conclusion

Getting a GST registration is now easier than ever with the online process in 2025. Still, many businesses face delays due to documentation errors or technical issues on the portal.

👉 At Professional Duniya, we provide fast, affordable, and hassle-free GST registration services to help you stay compliant and focus on your business growth.

📞 Call us today at

📧 email professionalduniya@gmail.com to get started!

Professional Duniya

© 2025. All rights reserved with Professional Duniya

Usage

Services

Trademark Filing

Partnership Registration

Growth